Is investment a form of entertainment? In truth it is to some extent – a guilty extent. The thrill of the casino win, of the horse that comes first, of the lottery – these are real and the truth is that people enjoy losing. They see it as a price worth paying for the excitement along the way.

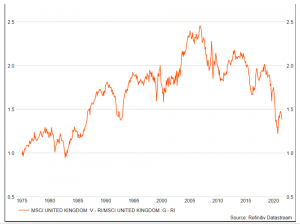

Professional investing is the very opposite of all this. Excitement is its bitter enemy. You don’t believe it? Then take a look at this chart. It compares the total return from UK value shares to UK growth shares.

MSCI UK value shares versus growth shares

The chart records which type of shares is doing better: value or growth? The higher the orange line goes, the better the return from value shares compared to growth shares. It’s measuring relative performance, not absolute return. For both categories the dividends are reinvested. Dividend yields are a key difference between value and growth shares and their contribution is easily forgotten when people are seduced by the share price alone.

Isn’t it striking that value wiped the floor with growth for decade after decade? The aftermaths of the 1987 crash and the 2000 Y2K bubble were particularly painful for growth. On the other hand, the great financial crisis reversed the trend as bank margins were squeezed by quantitative easing.

Woke or broke?

The surge in wokeness and ESG, and its pretentious investment chum, is creating some remarkable opportunities. Wokeness is a venting of righteous anger and ESG is its politer virtue-signalling counterpart. Even supposing the business behaviour demanded by ESG could be expressed coherently, which is a big ask, it must still sink or swim in the Darwinian swamp of capitalism. Governments have the luxury of pursuing common goods and hobbyhorses whereas companies have to deliver profits.

Of course profits can be adjusted and improved in all manner of creative ways. The compelling virtue of the dividend is that it’s either paid or it isn’t. The nearest we come to fake dividends is where they are all paid in scrip instead of cash. Virtue-signalling is fun but it’s a luxury. For instance, selling all energy stocks because shock horror, it turns out they emit CO2, is poor reasoning. Basing the decision on the threat from cheaper renewables is better reasoning. Until mass electricity storage emerges, renewable power can never be a full solution, however cheap it gets. Like it or not, oil consumption will remain high for years. Deep offshore drilling has always been expensive and risky. It seems best avoided until, say, carbon capture improves its long-term viability. Cheap onshore drilling is another story. Of course risks should be carefully examined but blanket bans are just lazy and irresponsible. In fact they create excellent opportunities as entry prices fall. This isn’t evil capitalism, it’s responsible investing.

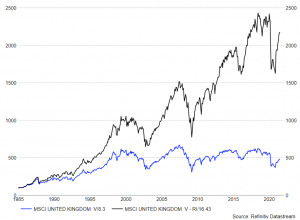

Now two charts which ram home just how crucial dividends are for investors.

Value shares with and without dividends reinvested

Black line – value shares with dividends reinvested

Blue line – value shares without dividends reinvested

Growth shares with and without dividends reinvested

Purple line – growth shares with dividends reinvested

Blue line – growth shares without dividends reinvested

These charts don’t need much verbiage to support them. Since January 2000 dividends have brought more than 100% of the return from value shares (ie their prices have actually gone down) and the lion’s share of it for growth stocks. If you buy a share which pays no dividends, you need to be very confident it can use the cash more productively than the rest of the market if returned by dividend. The simplest trick is for a company to boast that its share price has beaten the market, while of course not admitting that its total return has been sub-par.

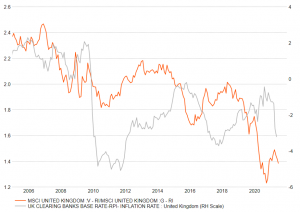

When Quantitative Easing (QE) goes away, value returns

Will the post-2008 underperformance of value come to an end?

This chart compares the relative performance of value to growth (not good) to UK bank base rates minus RPI inflation. Far from cheap money boosting the relative attraction of dividends, instead it has made capital growth more alluring. Falling real interest rates increases the value today of profits in the dim and distant future. This is why it has been easier to make money from growth than value since QE arrived. We are thankfully nearing the end of that experiment and therefore a return to the previous pattern of value outperforming growth seems likely. Interest rates will rise, taxes will rise a bit and government will keep on spending. Rising rates will be good for you. The message is in the charts.

Important: Slater Investments Limited does not offer investment advice or make any recommendations regarding the suitability of its products. No information contained within this article should be construed as advice. Should you feel you need advice, please contact a financial adviser. Past performance is not necessarily a guide to future performance. The value of investments and the income from them may fall as well as rise and be affected by changes in exchange rates, and you may not get back the amount of your original investment.