There are two reasons to love equity Income funds.

The first is the power of re-investing the income. Most market indices, such as the FTSE, the Dow-Jones or the Nikkei, are capital only, so ignore the income investors would receive from owning those equity markets. Ignoring the income is to ignore a major plank of the total return, particularly if the dividend yield is quite high and the capital gain has been moderate.

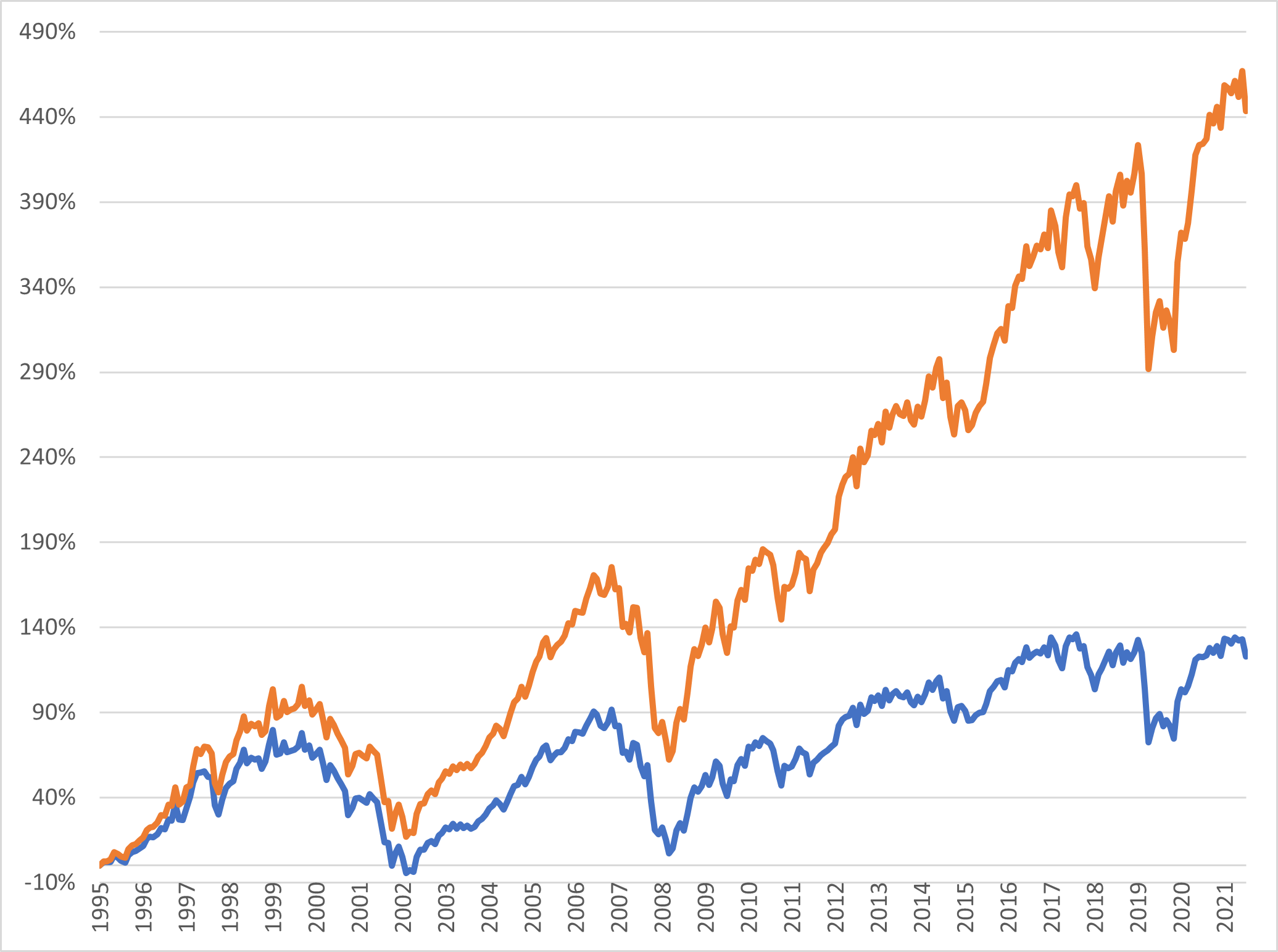

This is certainly the case in the UK. The chart below simply compares the UK equity stock market, on a capital only basis (the blue line) and with dividends re-invested (the orange line). It is easy to see that while the capital only index has been unexciting, the total return has been dramatically better.

Source: Slater Investments

This divergence, and the salutary effect of reinvesting income, is more pronounced over longer time periods. The more time given, the greater the compounding effect. Einstein is alleged to have described compounding as “the eighth wonder of the world”. Certainly, earning dividends on your dividends is a cheering thought.

The chart here goes back to 1995. That’s a long time in fund management, but perhaps is about the period a working person might save into their SIPP, or a parent might save for a child. So this is not an academic point about maths. This demonstrates that long-term savers should reflect on the merits of income vehicles as a way to generate serious total returns. The Slater Income Fund (and indeed most equity income funds) offer an Accumulation unit where the dividends are automatically reinvested.

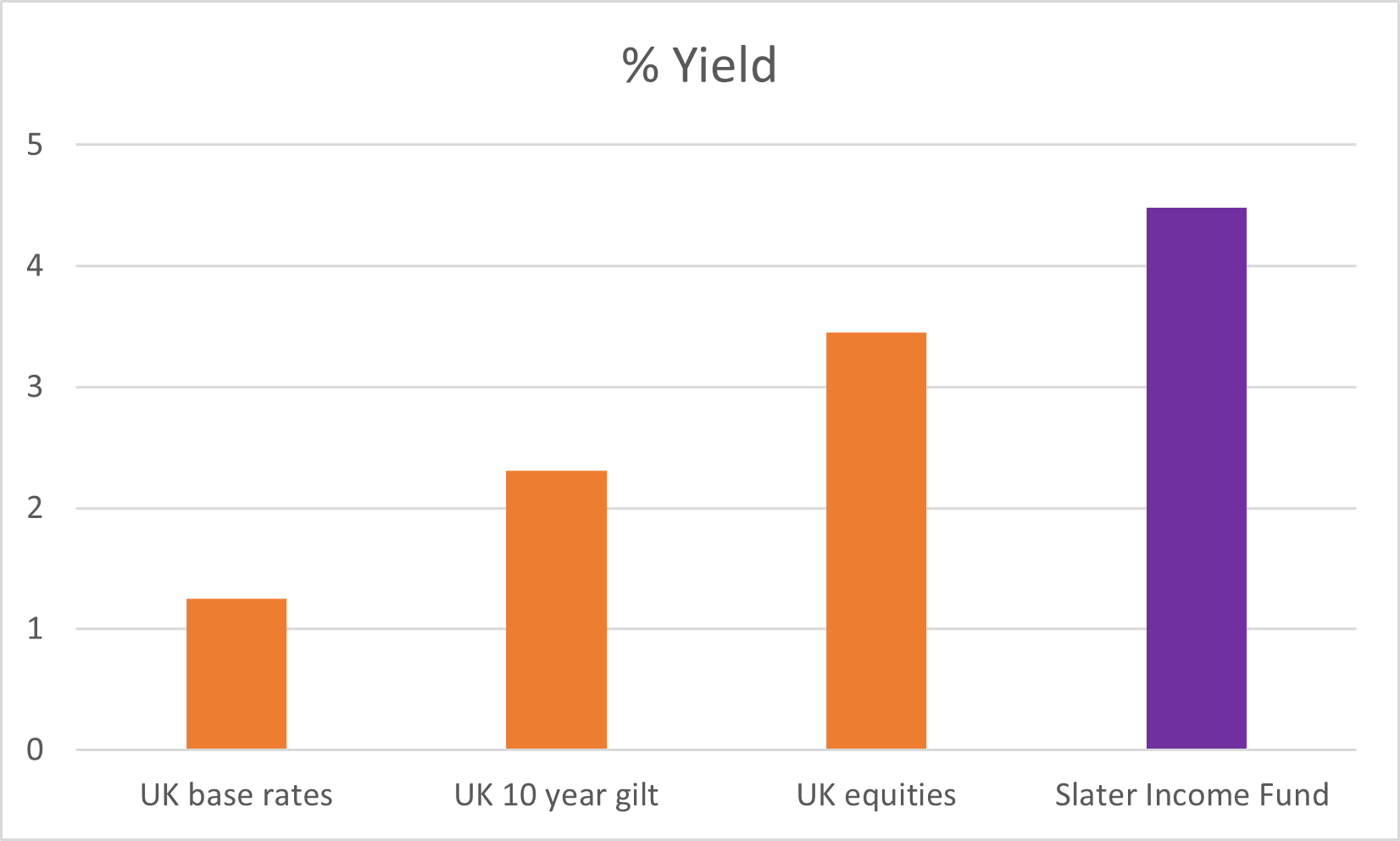

The second reason to love Equity Income funds is the terrific yields that are available. The chart below compares the yields available on UK cash, bonds, equities and the Slater Income Fund at the end of June. Despite the first interest rate rises in the UK, equities still yield more than bonds. This is bizarre, given the probability that equity dividends will rise over time versus the certainty that bond coupons will not. The Slater Income Fund is yielding handsomely more again that the wider UK equity market.

Source: Slater Investments

The Income unit class of the Slater Income Fund (and indeed most equity income funds) pay dividends directly to unitholders. In our case the dividend is paid quarterly so there is a steady cadence of meaningful returns. This means unit holders can enjoy a natural income without having to sacrifice capital. This, we think, is attractive for people who are moving towards decumulation, those who are no longer working for their money, but are looking to have their money work for them.

So, two reasons to love UK equity income, and two unit classes (Accumulation &/or Income) to facilitate it.

Risk Warning: Past performance is not necessarily a guide to the future. The value of investments and the income from them may go down as well as up. Investors may not receive back their original investment. The Funds have a concentrated portfolio which means greater exposure to a smaller number of securities than a more diversified portfolio. Charges are not made uniformly throughout the period of the investment. The Funds invest in smaller companies and carries a higher degree of risk than funds investing in larger companies. The shares of smaller companies may be less liquid and their performance more volatile over shorter time periods. The Funds can also invest in smaller companies listed on the Alternative Investment Market (AIM) which also carry the risks described above. The Funds may invest in derivatives and forward transactions for the reduction of risk or costs, or the generation of additional capital or income with an acceptably low level of risk which is unlikely to increase the risk profile of the Funds significantly. This email is provided for information purposes only and should not be interpreted as investment advice. If you have any doubts as to the suitability of an investment, please consult your financial adviser.

The latest Key Investor Information Documents and Prospectus is available free of charge from Slater Investments Ltd and on their website. You are required to read the Key Investor Information Document of the Fund and the Supplementary Information Document before making an investment. Telephone calls may be recorded. Slater Investments Ltd, which is authorised and regulated by the Financial Conduct Authority, is the manager of the Slater Income Fund. Slater Investments Ltd address is Nicholas House, 3 Laurence Pountney Hill, London, EC4R 0EU.

Slater Investments does not offer investment advice or make any recommendations regarding the suitability of its products. No information contained within this website should be construed as advice. Should you feel you need advice, please contact a financial adviser. Past performance is not necessarily a guide to future performance. The value of investments and the income from them may fall as well as rise and be affected by changes in exchange rates, and you may not get back the amount of your original investment.

Regulatory: Slater Investments Limited is authorised and regulated by the Financial Conduct Authority Registration Number: 165999